News

Increasing the prices and reducing the affordability of tobacco and tobacco products have been proven to be the most efficient and cost-effective instrument for controlling tobacco consumption. This way, the overall use of tobacco can be reduced and the government’s revenue can be increased manifold. Owing to the complex and defective tobacco tax system, however, Bangladesh hasn’t been able to implement any notable tobacco control measures yet. Therefore, the necessity of a comprehensive ‘National Tobacco Tax Policy’ has become essential. This has been stated by the speakers on (25 Nov. 2020, 16:00) at an international webinar entitled “Trends in Tobacco Taxation in South East Asia, with a special focus on Bangladesh.” Bangladesh Network for Tobacco Tax Policy (BNTTP), Bangladesh Anti-Tobacco Alliance (BATA), and the World Health Organization Knowledge hub on Tobacco Taxation and Illicit Trade have jointly organized the webinar.

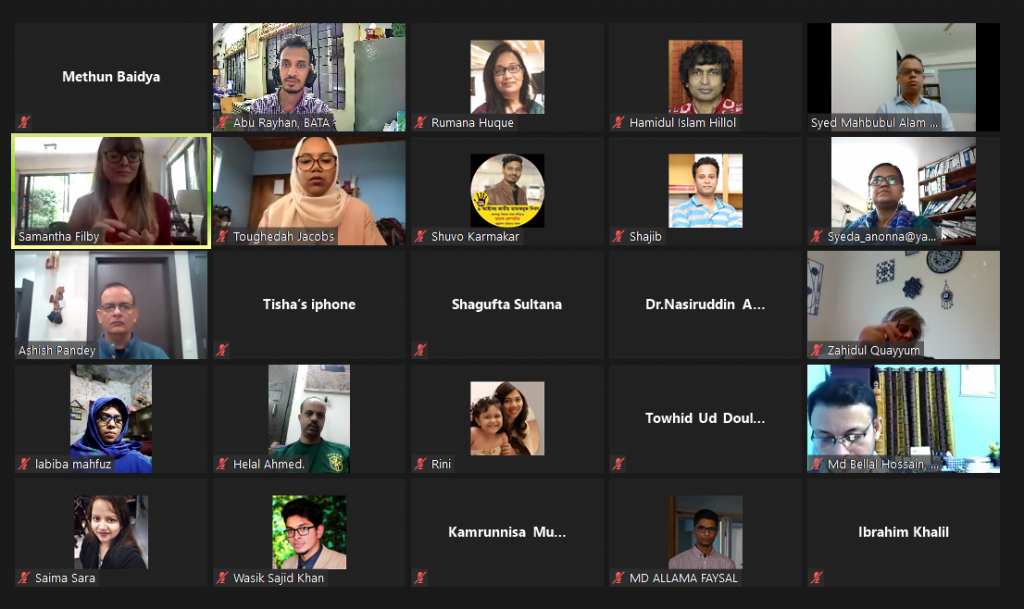

In the webinar, Ms. Sam Philby, Research Officer and Program Manager of the WHO Knowledge Hub on Tobacco Taxation and Illicit Trade delivered a presentation on ‘South-East Asia: Trends in Tobacco Taxation’. In addition to that, Dr. Rumana Huque, Professor at the Department of Economics, University of Dhaka and the convener of the technical committee of BNTTP delivered a presentation titled ‘Tobacco Taxation in Bangladesh’. Mr. Ashish Pandey, Deputy Director of tobacco control at the Union was present at the webinar as an expert discussant.

The welcome speech was delivered by Ms. Toughedah Jacobs, Program Director, WHO KH on Tobacco Taxation and Illicit Trade. Advocate Syed Mahbubul Alam, Technical Advisor of the Union moderated the webinar.

The speakers further mentioned that the numerous options to switch among brands and tiers following a price increase coupled with the evident complexities of the existing multi-tier tobacco tax structure act as major threats in the way of controlling tobacco in Bangladesh. Adopting an up-to-date and effective tobacco tax structure can rightfully eliminate this conundrum. The honorable Prime Minister has declared to make the country tobacco-free by 2040 and voiced the need to formulate a comprehensive tobacco tax policy to achieve this goal. Hence, to comply with her commitment, establishing a national tobacco tax policy is of growing importance right now. The policy must include key themes of tobacco control such tax imposition, tax administration and monitoring, tracking & tracing, prevention of tax evasion, export, and import policies, and so on.

According to the speakers at the webinar, the ad-valorem excise tax system has little to no effect on tobacco control and revenue generation in Bangladesh. On the contrary, it has been assisting the tobacco companies in maximizing their profits. Despite a twofold increase in the production of tobacco products in the last 10 years, the industry’s profit has increased tenfold. The best possible solution in this situation would be imposing specific taxes on all tobacco products along with the current system of ad-valorem excises taxes, as the speakers recommended.

Multiple economists, tobacco tax experts, and tobacco control activists from Bangladesh, South Africa, India, Myanmar, Vietnam, Colombia, and Sri Lanka attended the webinar.